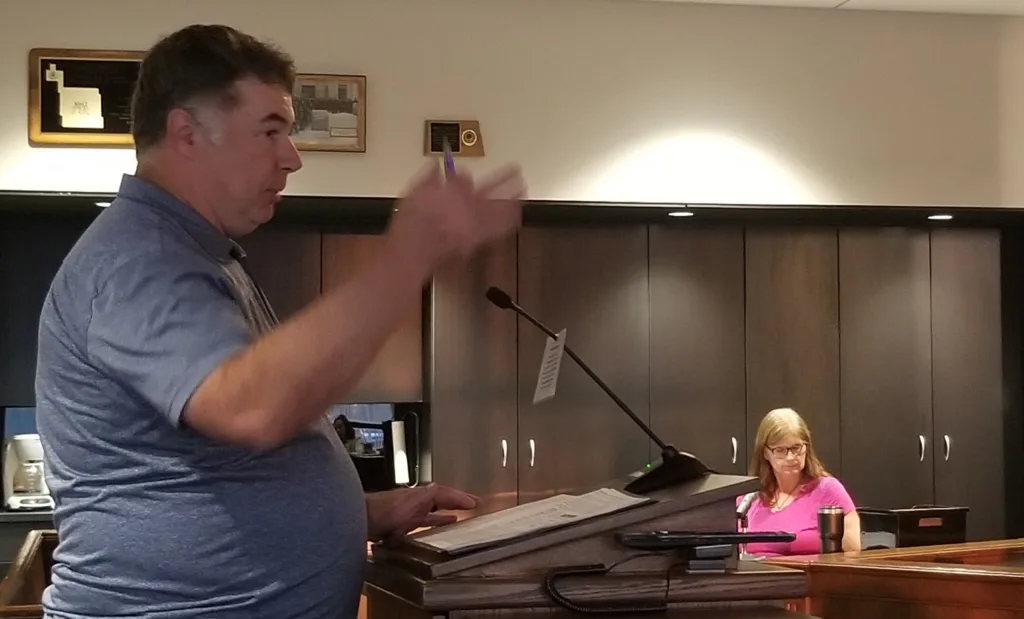

MINOT -- “This places us in the top nine states, nationwide, for property taxes,” said Mike Blessum, in voicing his opposition to proposed property tax increases in Ward County during a public hearing Tuesday evening in front of Ward County commissioners. “While my home value has increased 14% my property taxes have gone up 78%.”

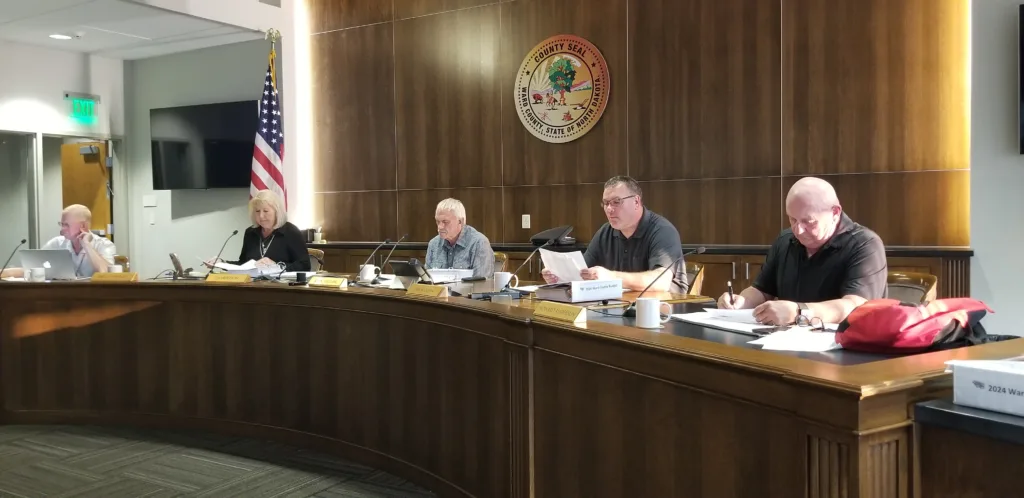

Blessum was one of several citizens to address the commissioners regarding proposed increases in property taxes. A local business owner, Blessum explained that raising wages to retain employees was losing ground due to rising taxes, a situation he said would eventually drive young people out of the state. About 25 people attended the meeting, chaired by Commissioner John Fjeldahl.

Steve Moen, Minot, told commissioners that his property tax has doubled since 2013 and that “taxes are higher than in California where people are leaving.”

A Burlington area property owner said her property taxes increased 232%, which commissioners agreed should be remedied with a visit to the county assessor’s office.

Some who addressed the commissioners questioned property tax dollars being given to entities such as the North Dakota State Fair and Garrison Diversion. Commissioners agreed to take a closer look at those and other expenditures before formalizing the proposed budget.

Minot resident and State Legislator Larry Bellew, retired and on a fixed income, told commissioners he was “very upset” with continued property tax increases.

“Just stop raising our taxes,” said Bellew. “My taxes have increased by 49% in six years.”

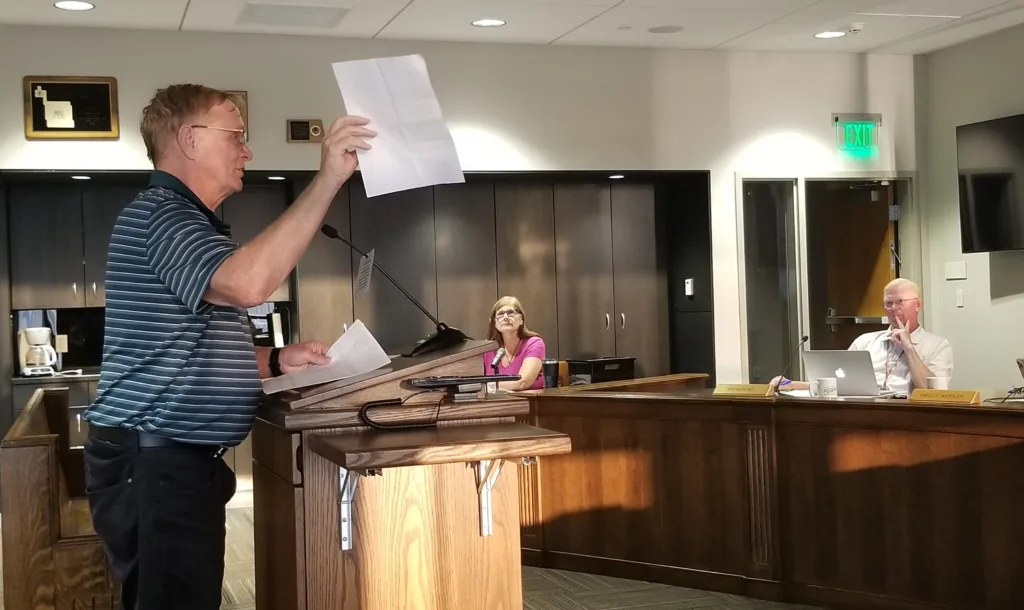

Minoter Scott Samuelson questioned why commissioners felt the need to give $400,000 to the State Fair and $372,000 to Garrison Diversion. He also brought up the End Unfair Property Tax effort to gather enough signatures to place an initiated measure to abolish property taxes on the statewide ballot in the June 2024 primary election.

“It’s time to tell the state of North Dakota to stop it,” said Samuelson.

Chairman Fjeldahl asked the gathering who was afraid of what would happen if the elimination of property taxes should succeed. Only a few in attendance raised their hands.

Blessum returned to the podium, cautioning commissioners not to make public comments without first reading the proposed initiated measure.

“Please read the measure,” urged Blessum.

Commissioner Jason Olson told Blessum that he hadn’t read the measure but would do so, adding that his initial response to the End Unfair Property Tax movement was that he had more questions than answers.

Chairman Fjeldahl said commissioners would meet and discuss concerns voiced at the public hearing, adding that “We have to pass the budget by October 10.”