MINOT – There's a better way to do it. That was the message delivered by Rep. Scott Louser, R-Dis. 5, Minot, during a press conference held at the City Auditorium.

Louser has penned a 23-page bill that he hopes to introduce to the 2025 legislative session. However, that would happen only if an initiated measure to eliminate property tax in the state fails to get on the ballot or be voted down in the November 2024 election.

“I believe this is a better route,” said Louser. “It is legislative, not Constitutional. I think there’s a lot of unknowns that go with the Constitutional measure.”

The biggest hurdles to the bill, said Louser, was that some legislators want to see property tax reform and others are pushing for zero income tax. Those are among the reasons Louser wants to put his proposed bill in front of legislators several months prior to the 2025 legislative session.

“I think it’s important to have this out in the public, to have some transparency and debate long before we get into the session,” explained Louser. “If there’s concerns about this bill, I want to know about them. If it’s the right thing to do for North Dakota it will be the biggest bill in our session.”

Louser estimated the price tag to be $675-825 million, “depending on what the bill looks like” following legislative revision.

Louser, who has filed to run in the upcoming Minot School Board election, said his proposed bill “obviously coincides with the budget issues we’re having in Minot with the School Board.”

Those issues include a budget deficit of over $6 million and possible closure of two elementary schools.

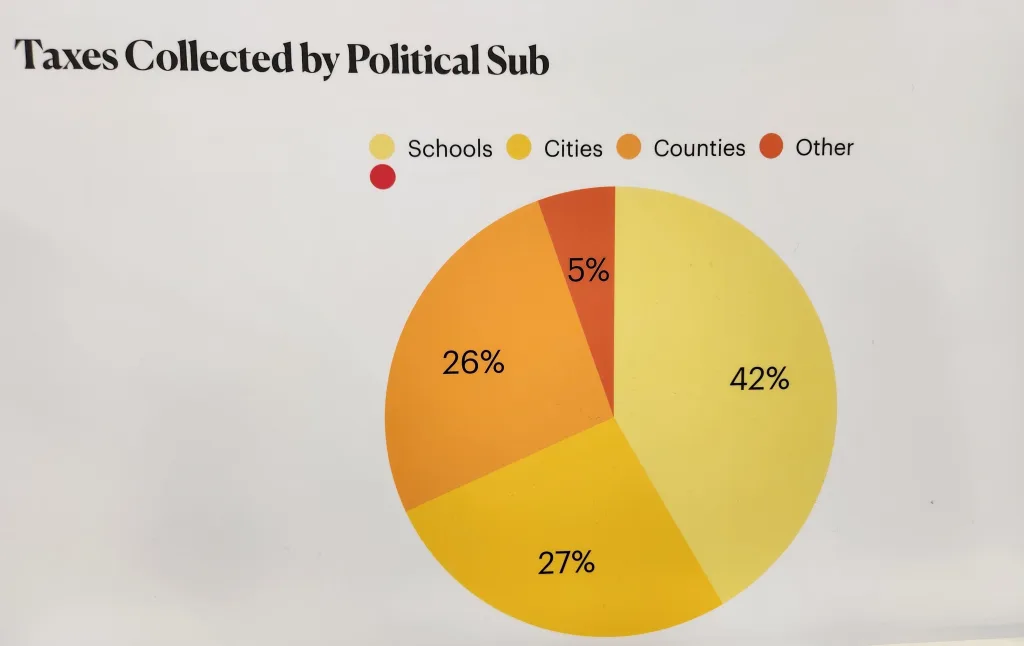

Louser said more than 40% of property tax is for K-12 education. He described his bill as having three main elements:

1—Provide up to 50 mills off property tax for public education.

2—Apply a cap of 3% for sub-divisions on property tax increases going forward.

3—Private schools that would like to participate in public funding would get 80% of the current per pupil payment, approximately $8,500 per student.

“This route gives legislators flexibility,” stated Louser. “We can amend the bill. We can’t amend the Constitution unless you go through the whole process.”