You're walking through the store, minding your own business when suddenly it grips you. You see something on sale, a novelty item, something you've long wished for and you are seized with the impulse to buy it.

Impulse buying is probably one of the biggest threats to your budget. It's important to understand how you respond to buying and to be mindful of the emotional and social impact of shopping. Think about your emotional reaction to buying things. When you make an impulse purchase, how does it make you feel? Did you feel a long-term satisfaction or was it a short-lived rush of happiness, maybe followed by feelings of regret? How much of your buying is to address feelings of need, dissatisfaction or frustration?

Resistance is not futile

It may be hard to resist, especially if it is an item you've wanted for a while, but here are some things you can do:

Always have a list and a plan for your purchases. This is the #1 rule for keeping grocery costs down, and it applies to everything else as well. Before you go shopping create a list of what's essential. Plan your route through the stores to get only these items on your list, avoiding areas where things not on your list may tempt you.

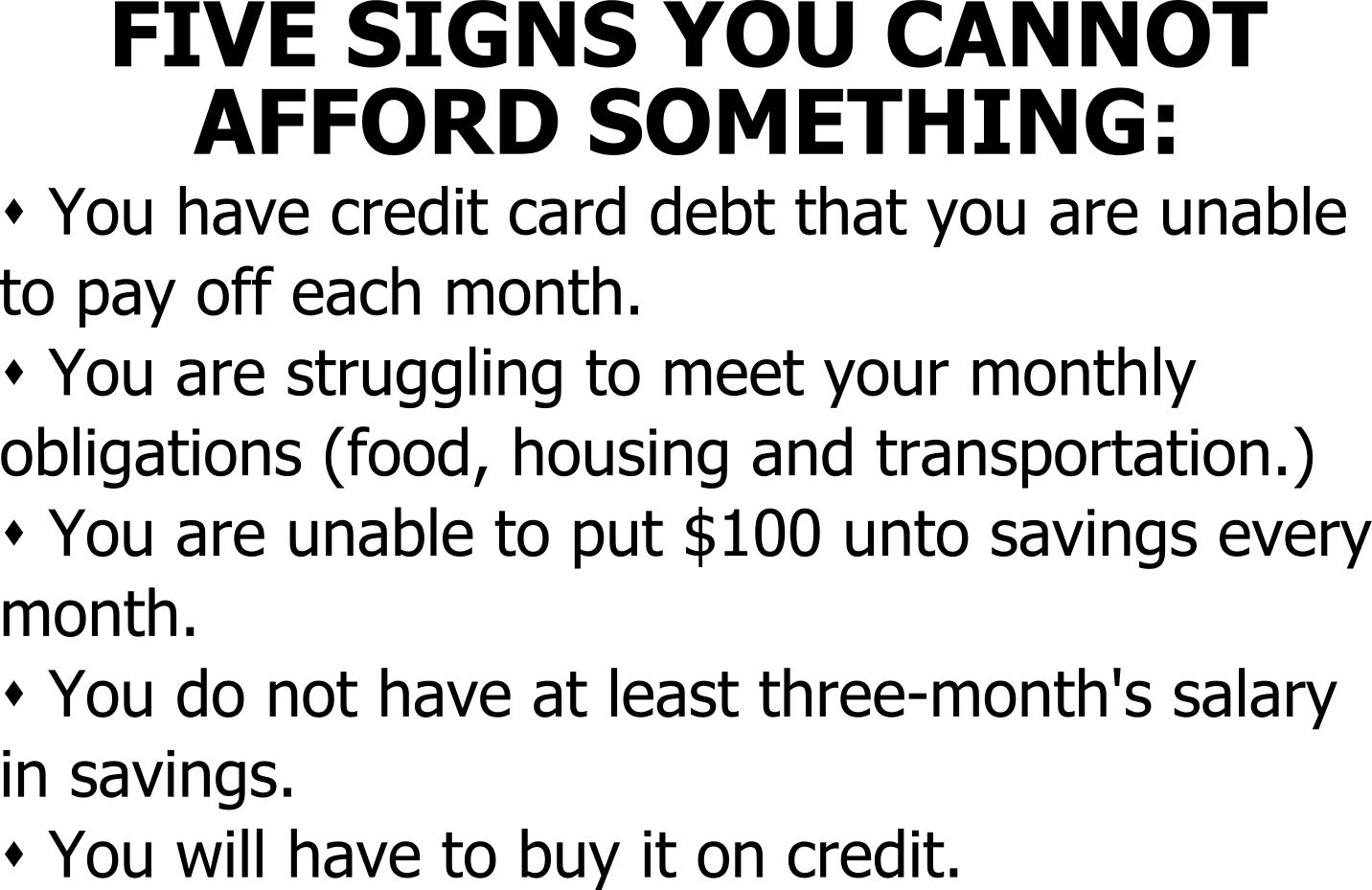

Shop with cash or check. It's too easy to lose sight of what a purchase costs when you use a debit card that magically gets you what you want. A checkbook and cash provide you instant feedback on what the purchase really costs.

Don’t carry more than one credit card. Use your credit card only in times of emergency or for already-budgeted items.

Put your credit card inside an Impulse Buying Card. This is a simple card that you can print out and cut to size. Put your credit card inside. Every time you go to make a purchase, read the questions on this card to make sure that this is a wise use of your credit card.

Don’t go shopping in groups. Along that same line, don't make shopping a hobby or a social outlet. Only shop when you are buying essentials, like food and other necessities.

Avoid online shopping websites. It's too easy to just click something into your shopping cart without really considering the reality of what that will cost you. Also, online retailers use cookies to track you. They know your habits and your weaknesses and will target ads for things you are likely to buy.

Put it on hold for 30 days. If after a month you are still thinking about the product and still feels like it would benefit you, go ahead and buy it.

Start a wish list. When Christmas or your birthday come around, if friends or family ask what you'd like, you can tell them what's on your list. It will be an especially welcome gift, because you know that you've thoroughly researched it to know it's the best thing you could get.

Save for the purchase while researching the item. This is especially important if you are making a big purchase. Research consumer reports, talk to others who have the product, maybe ask if you can borrow or use it to see if it meets your expectations.

While you are researching the item, start setting aside money so that in a month or two you've saved up what you need to purchase it without using credit. In the meantime, watch the price. I use the Honey extension on my browser. It tells me where I'll find the lowest price for an item and send me alerts when the item's price starts to drop.

There is no greater feeling than buying something after you have thoroughly researched it, you know it is the right buy and you have paid cash for it!

Remember your goals

Keep your financial and personal goals in mind before spending money without a clear purpose. Perhaps you are trying to save a certain amount of money to have in a savings account, or you want to plan a trip across the country but can't afford it. Think about these goals and remember that your small impulse purchases add up to a lot of money, and can prevent you from meeting your goals.

Adopting this new mindset may be challenging but you will be happier and more financially secure, if you can manage money and not have it manage you. With practice you will find that you get as much of a thrill from saving money as you do from spending it.

Print out this Impule Buying Card and put your credit card(s) inside:

http://www.providenthomecompanion.com/wp-content/uploads/2014/03/Impulse-buying-card.pdf