BISMARCK – Not all were in agreement with Republican Governor Doug Burgum’s flat rate income tax plan Wednesday when it was heard in committee.

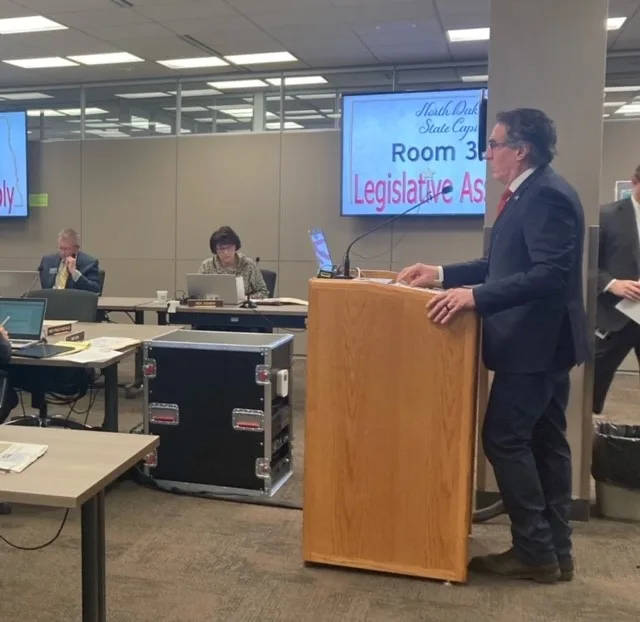

Burgum presented the plan, House Bill 1158, which is a one and a half percent flat tax rate, to the House Finance and Taxation committee as the biggest income tax relief in state history.

“This bill would eliminate individual income tax for about three out of five taxpayers,” Burgum said. “Think about that. Sixty percent of North Dakotans would finally be in a position to be income tax free.”

The top 40% of income earners who would still pay individual income tax would have their liability reduced by one fourth or one half, Burgum says. He estimates a tax relief of $566 million with his plan, being the lowest flat tax rate in the country. Burgum is hoping to eventually bring the rate to zero.

Representative Zachary Ista, D-Dis. 43, Grand Forks, said he received an analysis from legislative council which estimated $188 million of the total tax relief would go to filers in the current 5th tax bracket, which he said make over $491,000 a year. He also said $44 million of that would go to non-resident filers at that income level.

“What policy goals are we furthering by giving $188 million of tax relief to folks in that tax bracket?” Ista asked the governor.

Burgum repeated that 60% of North Dakotans will pay no tax.

“That means the remaining income tax will be paid by the top 40% of the filers,” said Burgum. “This concept that you can’t give tax relief to people that have the largest incomes, if you believe that you’re never going to get to zero tax relief. Regardless of your level you have an opportunity to keep those dollars and reinvest those dollars. You’ve got examples and examples and examples that people’s income levels move up and down.”

Burgum also responded to the concern of non-residents benefiting from the tax relief.

“This parochial idea that somehow the out-of-state is some individual that doesn’t care about the state or doesn’t have an interest in the state, then why should we do anything for anybody?” said Burgum. “I think we need to get beyond labels about out-of-state residents, and really understand who those people are.”

“It’s nice to not be the only one speaking on behalf of bills like this,” said Dustin Gawrylow, managing director of the North Dakota Watchdog Network, speaking in favor of the bill. “Since 2009, generally when these types of bills come up in this committee, there’s been very little support for them.”

Nine testimonies were heard in favor of the bill. One opposition was heard from Representative SuAnn Olson, R-Dis. 8, Baldwin.

Olson, an accountant who has worked 40 years in the tax arena, said she has not heard a client complain about North Dakota’s income tax rates in at least a decade.

“It felt like it was coming out of the blue,” said Olson. “From my viewpoint it doesn’t speak to what our citizenry has been asking of us. I think we all know they are calling for different kinds of tax reliefs.”

The Dakotan asked Representative Craig Headland, R-Dis. 29, Montpelier and Chairman of the committee about citizens’ concerns, if the state is focused on income tax reform instead of property tax reform.

“This is state government, and the state does not collect property taxes, so why should the state focus on the property tax problem when it’s really the jurisdiction of locally elected officials?” Headland responded.

“I agree it is not something we are fully in control of,” said Olson, when questioned about this. “But there are things we can do, and I know there are some bills that are coming before the legislature that will affect that in different ways.”

Olson shared further concern about a potential tax break being given to non-residents.

“When income from our state goes outside of our state, it’s no longer present in our economy,” said Olson.

Olson received information from the North Dakota Office of State Tax Commissioner that showed nearly $5 billion of income was reported by non-residents in 2021.