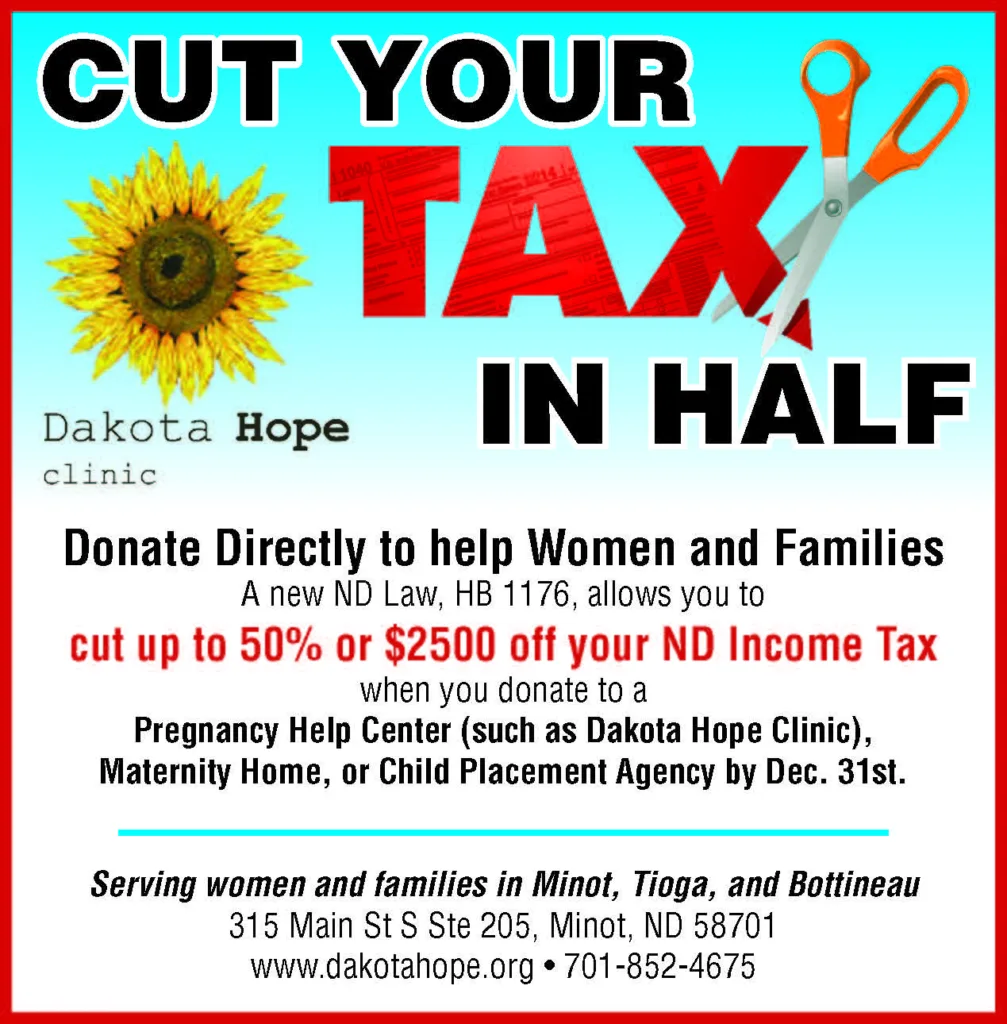

An innovative new law passed by the ND State legislature in 2023 can reduce taxes for individuals, businesses, and corporations, while freeing up more funds to help women, men, and families. According to section II of HB 1176, “a taxpayer is entitled to a credit against the (North Dakota) income tax liability … for contributions made to a maternity home, child placing agency, or pregnancy help center.” The amount of credit allowed is limited to 50% of what the taxpayer owes or up to $2,500, whichever is less.

For example, if a taxpayer owes $500 in ND income taxes, they only have to pay $250 if they have given at least $250 to the qualified ND charities. Because of the $2500 credit limit, a taxpayer who owes more than $5000 for ND income tax, would receive less than a 50% credit, but still a benefit for them and the charities.

Bottom line, the taxpayer is going to part with the amount of money they owe, but this law provides them a choice as to where up to half or up to $2500 of this money goes. Another positive aspect of this law is that these dollars do not have to go to the government first, where administrative costs would eat up a chunk of the money.

Dakota Hope Clinic operates non-profit pregnancy help centers in Minot, Tioga, and Bottineau and their donors are eligible for the tax credit. Clinic Director, Nadia Smetana, welcomes the extra incentive this law provides to their donors. “This is so important as the family is the foundation of our society. I know that each of the eligible ND charities can benefit from more direct donations. With the 35% growth we have seen in client visits, an 11% increase in new clients, and our new satellite clinics, Dakota Hope needs extra support and I like to see taxpayers have a choice in where their hard-earned dollars go.

Cindy Klingbeil, CPA is a tax preparer in Minot and serves on the Dakota Hope Clinic Finance Committee. She advises taxpayers to take advantage of the new law. “The important thing to remember is that the contributions must be given during the tax year, by Dec. 31, in order to take this credit on your 2023 income tax return. If you know or get an estimate of what your ND income tax bill might be, then you can plan to make your donations before Jan. 1.”

The law became effective for the 2023 Tax Year. Any credit amount exceeding the limitation for the taxable year cannot be claimed as carryback or carryforward. If anyone would like to know what they have given to Dakota Hope so far during this tax year, call them at 701-852-4675 or contact any of the three types of charities you choose.