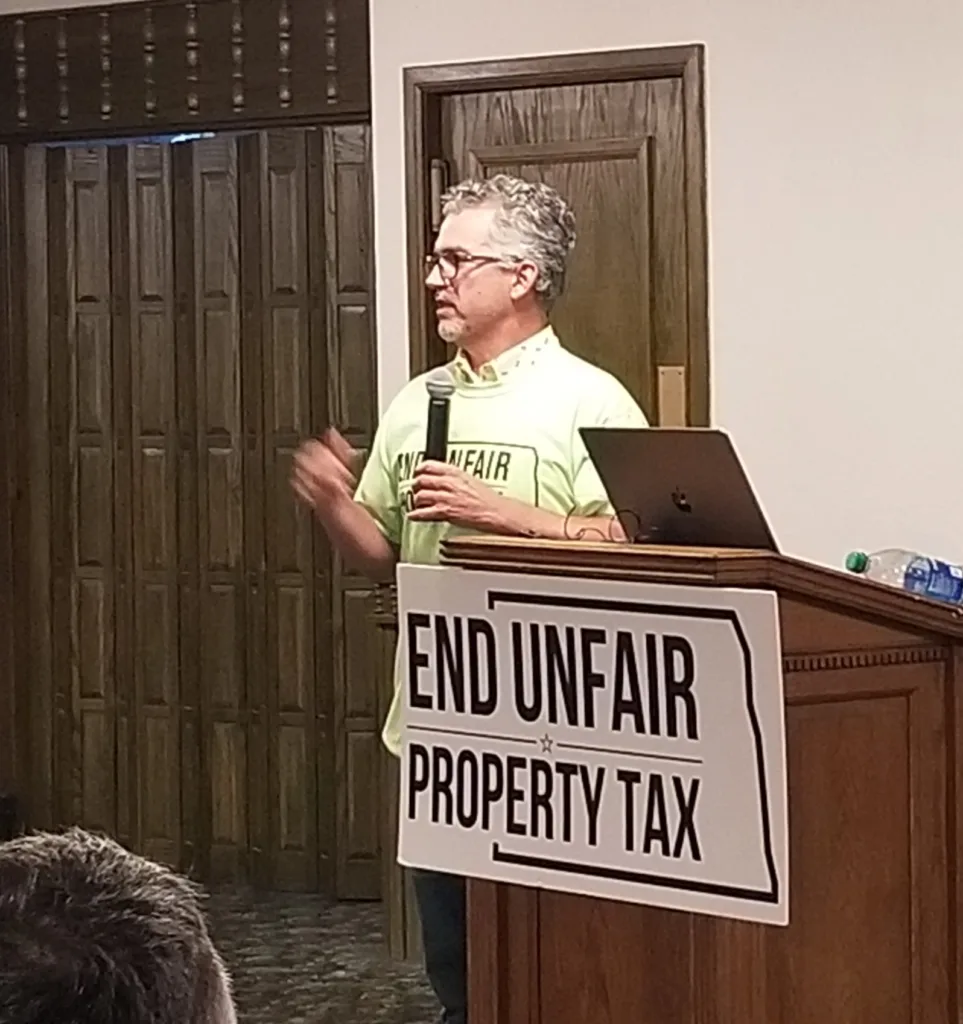

MINOT – Former state legislator from Bismarck and previous independent candidate for U.S. Senate, Rick Becker, promoted his latest endeavor during a gathering in the city Wednesday evening.

At the former Columbian Club on North Broadway, Becker explained why he is heading up “End Unfair Property Tax,” a petition drive that would place an initiated measure for the elimination of North Dakota’s property tax on the June 2024 primary election ballot.

About 31,000 signatures are needed to place the proposed measure on the ballot. However, said Becker, the goal is to gather closer to 45,000 signatures in the event that some are disputed when reviewed by the Secretary of State. A similar measure was proposed in 2012 but was defeated by what Becker called a “campaign of fear and distortion.”

Questions from those in attendance, about 80, primarily were focused on how the revenue lost from property tax would be replaced. Becker, a state legislature from 2012-2022 told the audience that the dollar amount can be replaced “very easily.”

“Every dollar that comes in, we find a way to spend it,” stated Becker. “We are overspending. It’s so easy to be generous with other people’s money.”

Becker cited the ease with which property evaluations can be increased, leading to increased property tax.

“You have no say in it,” said Becker. “Legendary? Legendary? The only thing legendary is the spending of our legislators.”

The amount of money collected each year by property tax on homes in North Dakota, said Becker, is about $1 billion. He said that could be made up with a 2% cut of the state’s budget or by limiting legislative “overspending that is $2.5 billion per year.”

The following is from www.endpropertytax.com:

Is it possible to have everything in place for the January 2025 effective date?

This measure will be well-known to be going on the ballot early in 2024. The legislature and Governor have the entire legislative session to hold hearings on drafted bills, amend them, and pass them. If absolutely necessary, they can have interim committees followed by a short special session during the remainder of 2025.

Property taxes levied in December 2024 will be paid February and March 2025. The first year in which property tax replacement will occur will be for the taxes that would have been due in February and March of 2026.

The legislative session of 2025 will be budgeting for the biennium of July 2025-June 2027. Payments to the local subdivisions can be made quarterly in January 2026, July 2026, Jan 2027, and July 2027. New or additional revenue on the local side could start July of 2025 or 2026, for example. This provides seamless revenue to the local subdivisions, and allows the state to generate revenue in the new biennium before the first installment is due to the local subdivisions.