BISMARCK – The North Dakota State House reversed an earlier decision and voted down a resolution Friday to give the option to voters to repeal a one mill levy property tax, a tax which funds the medical school at the University of North Dakota.

Senate Concurrent Resolution 4019 would have placed on the November 2024 ballot a measure to repeal article X, section 10 of the North Dakota Constitution. Section 10 imposes a one mill levy of property tax on all taxable properties in the state to fund the medical center at UND. This tax is the only property tax currently levied by the state.

SCR4019 received a 12-1 Do Pass recommendation from the House Finance and Taxation committee and passed the House floor Thursday by a vote of 53 to 34. On Friday the House voted Friday to reconsider the bill.

Proponents of the resolution agreed with the praise given to the medical school but believe the funding source should come from the general fund as opposed to property tax. Opponents said funding the school through property tax is more reliable as the general fund varies based on the economy.

Rep. Jared Hagert, R-Dis. 20, Emerado, had stated Thursday that UND supports the resolution but corrected his statement Friday saying the school is not in favor of the resolution.

“I think what we’re talking about here is the value of a mill,” said Hagert. “We know it’s gone up since 1949. We all like reliable funding sources that appreciate over time. But I think today’s economy, where we’re at, this is as good a time as any to take and put this measure on the ballot.”

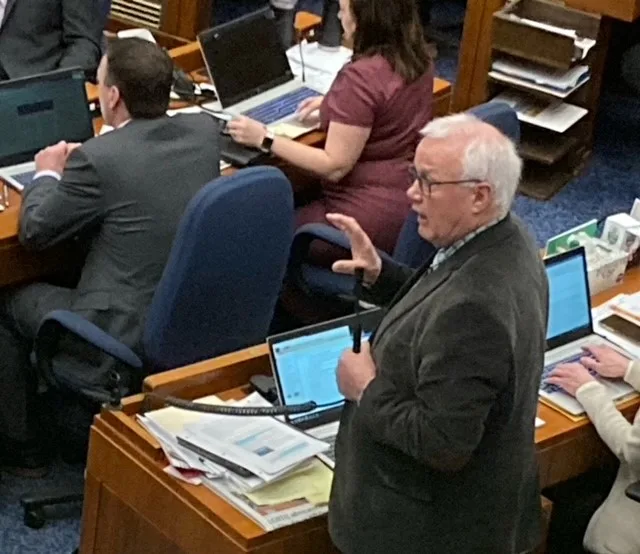

“This stable funding source is the only stable funding source this facility has,” said Rep. Jon Nelson, R-Dis. 14, Rugby. “Three fourths of the family practice physicians in North Dakota have gone through the residency program. You might ask why this carve out for higher ed should take place. One of the areas that we’ve been very successful in the medical school is residency.”

The resolution to repeal the property tax failed by a vote of 47 to 40.