Budgeting. Such a boring word and a tedious topic. It's also an emotionally fraught subject. So much of what we feel emotionally and how we respond to society is wrapped up in how we spend our money.

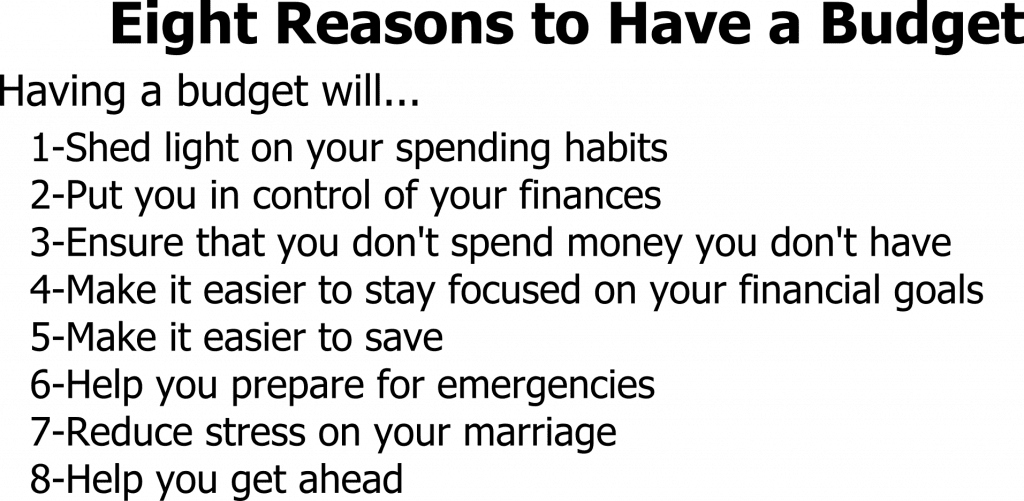

Yet budgeting is the first step to managing finances and is essential if we hope to make ends meet in this volatile economy. Before we can get to the nuts and bolts of making ends meet, we have to know what we're doing with our money right now.

At its root, budgeting is about setting priorities. What is most important to your well-being? That's where you will put your money first. It's a constant balancing act between wants and needs. What one person may consider essential; another person may think is frivolous. It's at that border between the “needs” and “wants” of spending that budgets fall apart.

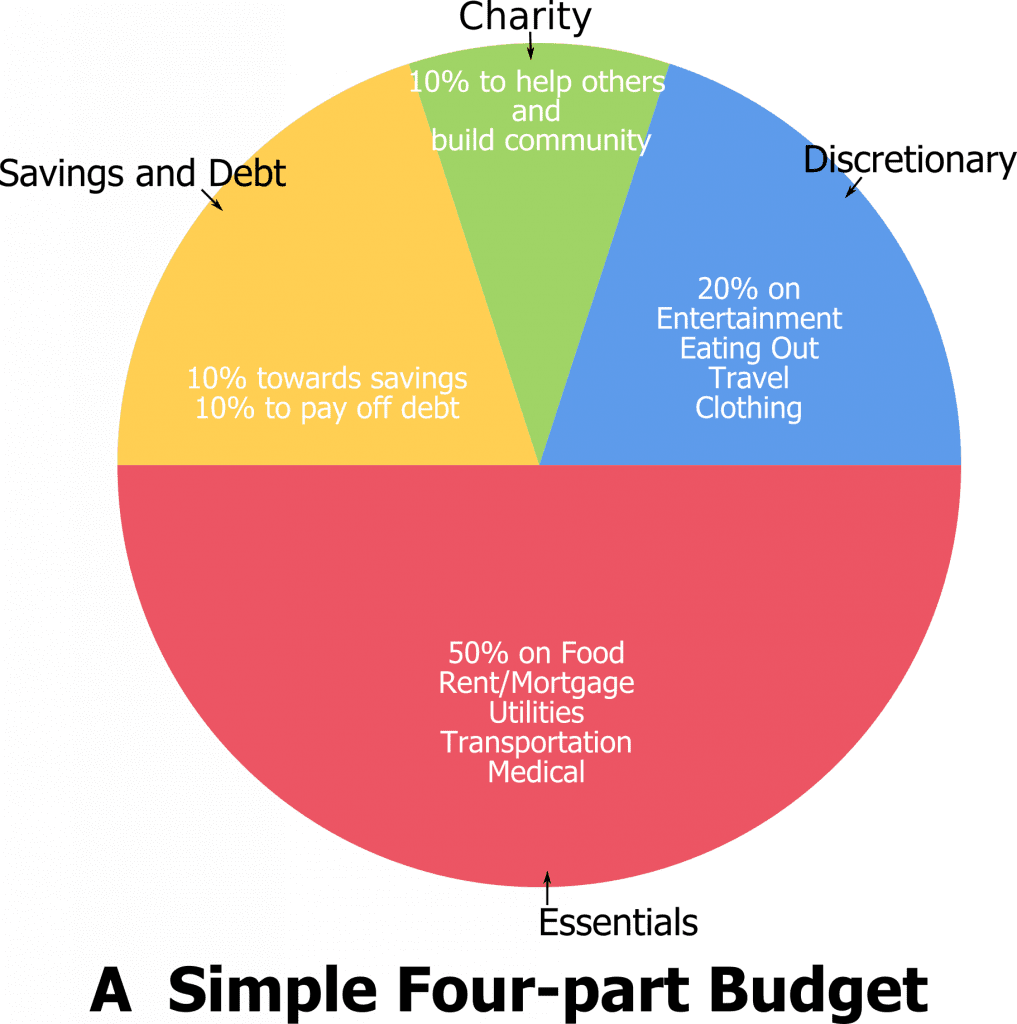

That's why it's important to put down a budget on paper. Having the outline of a budget mapped out somewhere in your head is not good enough. You need something written down that you and other family members can refer to whenever there's a question of how to spend money. If you've never written down a budget, you can start with this simple four-part budget:

A simple four-part budget

The first priority in any budget is to pay for the necessities: food, rent or mortgage, utilities, transportation and medical expenses. If you can't feed yourself and your family and don't have a safe place to sleep at night, nothing else really matters. So first things first: pay for the necessities. Your goal is to spend 50% or less of your monthly income on the necessities. If you can't stay in that 50% range, your housing and transportation are probably the two biggest culprits. Look at downsizing to a more modest home or get a more economic car.

After meeting the necessities, it's time to plan for and protect against the future. With today's volatile economy, it's more important than ever to pay down debt as much as possible. If you have any debt outside of a house, get rid of it as soon as possible. You should put 10-15% of your income towards savings and the remaining money should go to paying off debt. If you have no debt, congratulations! Then you should put a total of 20% into savings.

Some part of your clothing budget is essential. But be careful about the boundary between what clothing is essential and what's not. Who doesn't like to wear new and up-to-date fashions? It boosts confidence and can give the impression of competence. But is that really essential? This is one of those spending categories that carries a lot of emotional baggage with it. (Food is another.) Carefully examine your feelings about the clothing you purchase and decide if you are being pragmatic or using clothing as an emotional substitute for something else.

Remember, the whole point of setting a budget is to establish guideposts to help you save more and live on less. That means you may have to break old spending habits and rethink your perspective. Spending less may not be fun, but it gets easier as you create new habits. Be conscious of your spending decisions. Over time you will find that you take as much delight in saving money as you used to take in spending it on the non-essentials.

The four-part budget described above is just the first step to understanding your budget. For more in-depth help, take one of these free personal finance courses: https://personalfinance.byu.edu/test

Saturday Night Live makes budgeting easy: https://bit.ly/Simple_budget